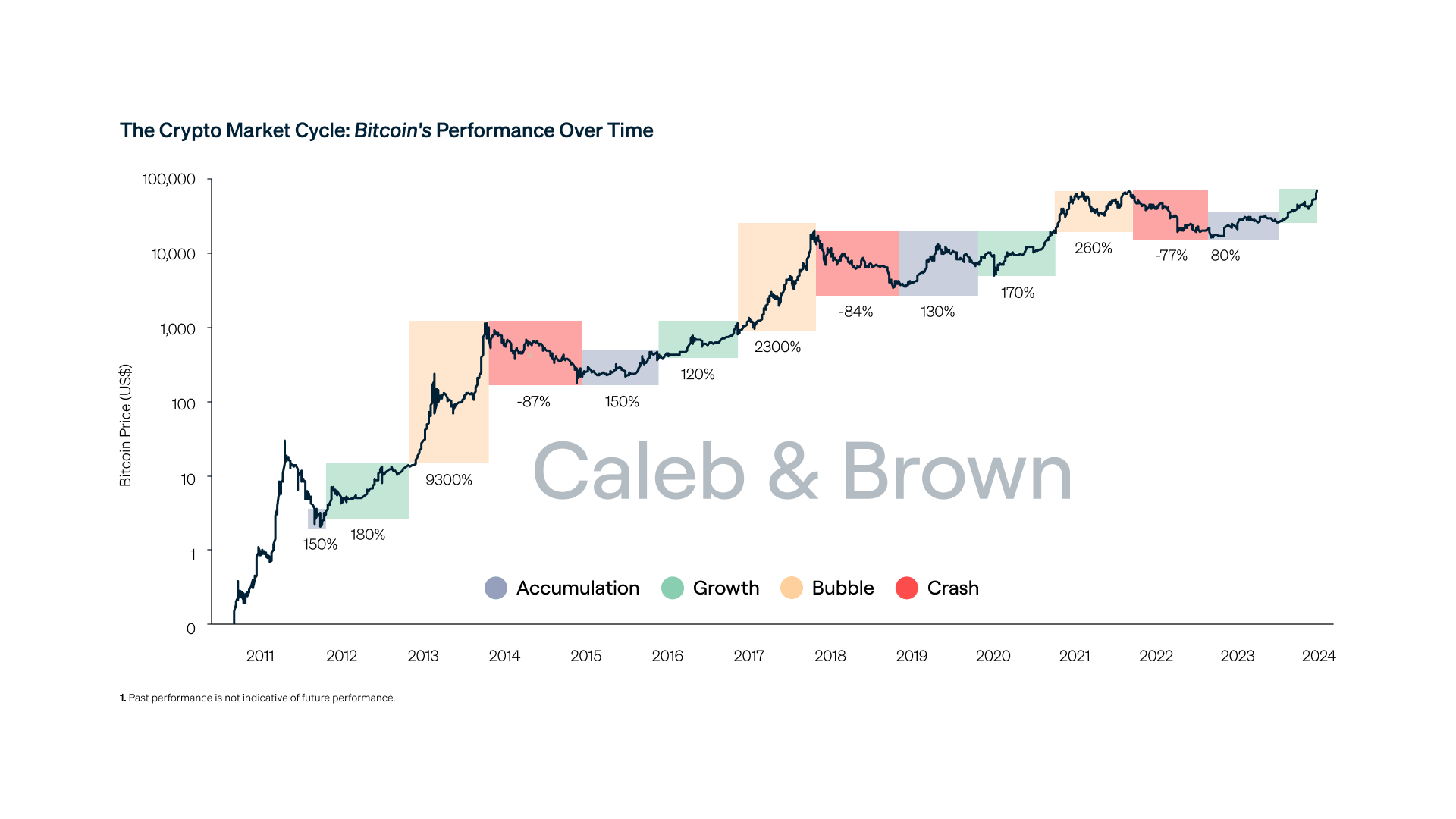

Throughout Bitcoin’s short history, its price has experienced enormous swings to new all-time highs, followed by retracements that take back most of the gains. Studying several Bitcoin (BTC) market cycles, it becomes clear that other than the first cycle, the others are relatively consistent regarding timing.

This trend is especially true of the last two cycles, which are close to four years each from peak to peak and bottom to bottom. Some have speculated that this timing results from the Bitcoin halving that occurs approximately every four years or 210,000 blocks mined. The question now is: Is the Bitcoin four-year cycle a real phenomenon or just a coincidence? And if it is real, what will it look like in 2024 and beyond?

Dissecting Bitcoin’s Market Cycles

For clarity, this article defines a market cycle from one bear market bottom to the next.

The first accurate Bitcoin price tracking occurred in July 2010. By October, Bitcoin’s price started to rise and peaked on June 8, 2011, at $31.90. The price began to fall over the next five months and bottomed at $2.01 on Nov. 19, 2011. This first cycle was the shortest of all the cycles to date.

Cycle No. 2 began at the 2011 bear market bottom on Nov. 19, after which the price bounced higher almost immediately. After the bounce, there was a six-month period of consolidation. After BTC broke out of the consolidation, it peaked at over $268 on April 10, 2013; a 76% drop followed that peak.

BTC recovered almost immediately and hit a bull market peak of $1,177 on Nov. 30, 2013. An 86% drop followed that peak; the bottom was hit on Jan. 14, 2015.

The third cycle began at the 2015 bear market bottom on January 14. For the first 9 ½ months, the price of Bitcoin accumulated in a range of about $100. After the price of Bitcoin broke out of the accumulation range, it re-tested the range once before moving higher.

The move higher culminated in the bull market peak at just under $20,000 on Dec. 17, 2017. Once again, a price drop of 84% followed the peak and the bottom was hit almost one year later, on Dec. 15, 2018.

The fourth cycle began on Dec. 10, 2018, and after about four months of accumulation, the price of Bitcoin broke out in a dramatic fashion. Over the next three months, the price of Bitcoin increased by over 200% and hit a high of $13,831 on June 26, 2019.

Over the remainder of the year, Bitcoin’s price slowly dropped but still finished up about 90% for the year. The start of 2020 saw a 45% increase in the price of Bitcoin, which peaked in mid-February. That was followed by the COVID crash, which bottomed in mid-March.

The recovery from the COVID crash was swift and eventually led to the next bull market. This bull market was reminiscent of the 2013 bull market. After pushing higher throughout much of 2020, the price of Bitcoin peaked on April 14, 2021. This peak was followed by a 55% pullback that bottomed on July 20.

Over the next month, the price of Bitcoin increased by over 134%, which led to the ultimate bull market peak on Nov. 10 at $69,000. Bitcoin’s price immediately began to drop and just over a year later, on Nov. 21, 2022, it hit what appears to be the bottom at $15,495.

By zooming out and looking at the entire price history of Bitcoin, you can calculate the timing of each market cycle. In the chart above, the green vertical lines mark the bull market peaks and the time intervals between them. The yellow dashed lines mark the bear market bottoms, with the time intervals between them.

Note the timing of the last two market cycles. They are close to a four-year cycle, from one peak to the next and from bottom to bottom. Another interesting observation is the time of year when the peaks and bottoms occur.

Other than the first peak in 2011, all the others occurred in November, December or January. Is this timing a coincidence, or is there a reason behind it?

It is also clear that with each successive cycle, the percentage increase in price for the year leading up to the halving is declining. The same pattern is evident from the halving to the following peak. Again, with Bitcoin’s short history, it is unclear whether this pattern will continue. Visually, it is easy to see the diminishing returns with each successive cycle in percentage terms.

Read more: Benzinga.com

:format(webp)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/AGJL5QTY25GGDMU7L73QGRG4XM.png)