Bitcoin Gold (BTG) is a hard fork of the Bitcoin blockchain that gives you the opportunity to double your number of coins.

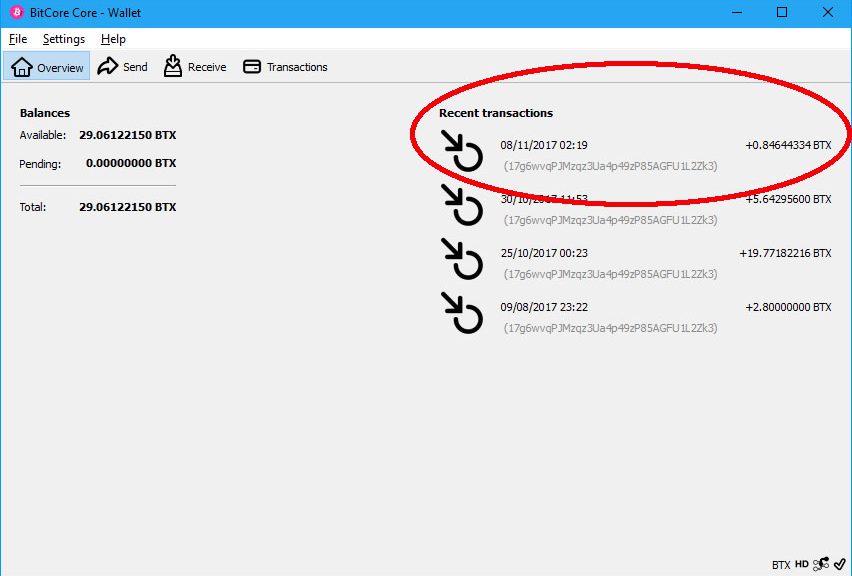

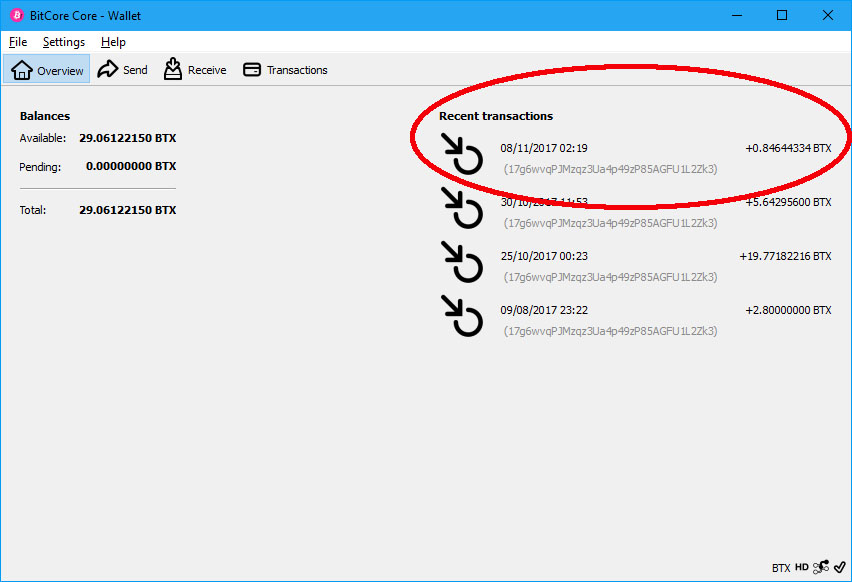

However, unlike previous forks such as Bitcoin Cash (which made me 0.8 BTC, currently worth about £4k), this one seems to have been very disorganised. It has been weeks since the official blockchain snapshot was taken and only now is there an official wallet available – and that’s painful and resource hogging to use.

Further, this delay led to extensive trading in BTG futures so the current value of BTG is fairly low – it started at about $500 but is now hovering around $150.

The process to claim is a bit fiddly so you need to decide if it’s worth the effort of claiming – in fact, I would say that unless you own at least 0.1 BTC it’s barely worth it because you’ll lose too much in fees.

To begin, check to see if you’re eligible for the new BTG coins – essentially that means you held Bitcoin in a wallet you controlled (i.e. for which you have the private keys) on Monday 23 October 2017 (officially Block 491407).

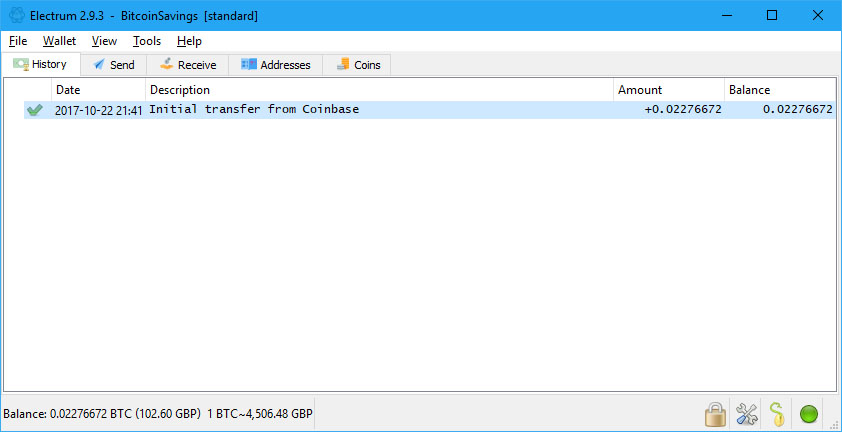

Let’s do that for the Electrum Wallet account we set up previously:

(Just as a matter of interest note the value of that account showing there, 0.0227 BTC, has a value in the screenshot footer of £102.60. Now, less than a month later, it’s £134.37).

We go to the Addresses tab and look for the address that holds our BTC. If you have done many transactions it may be split across addresses – in this case you will have to make multiple claims. Right-click on the appropriate address and choose Copy Address to get it into the clipboard.

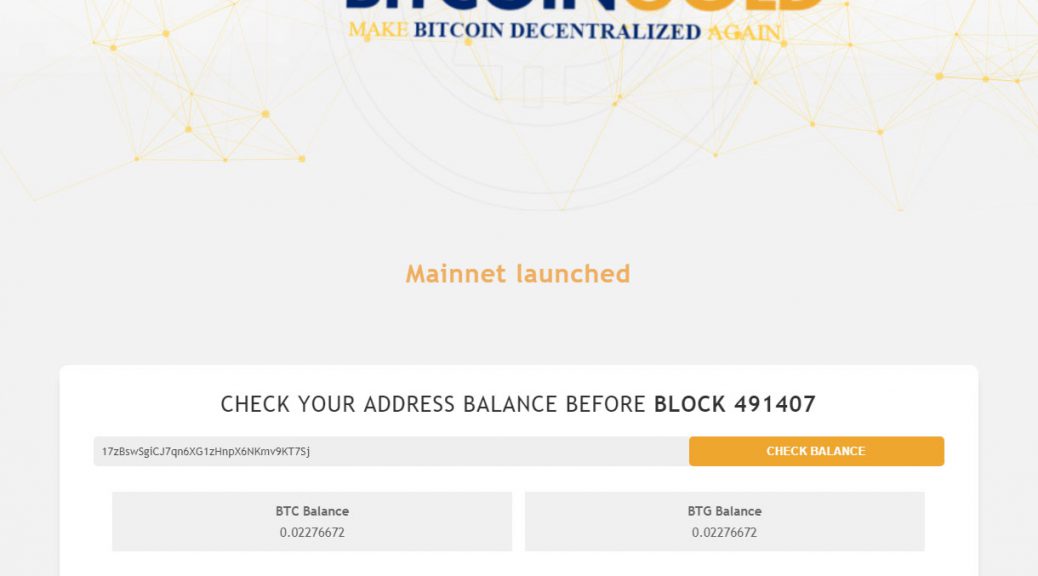

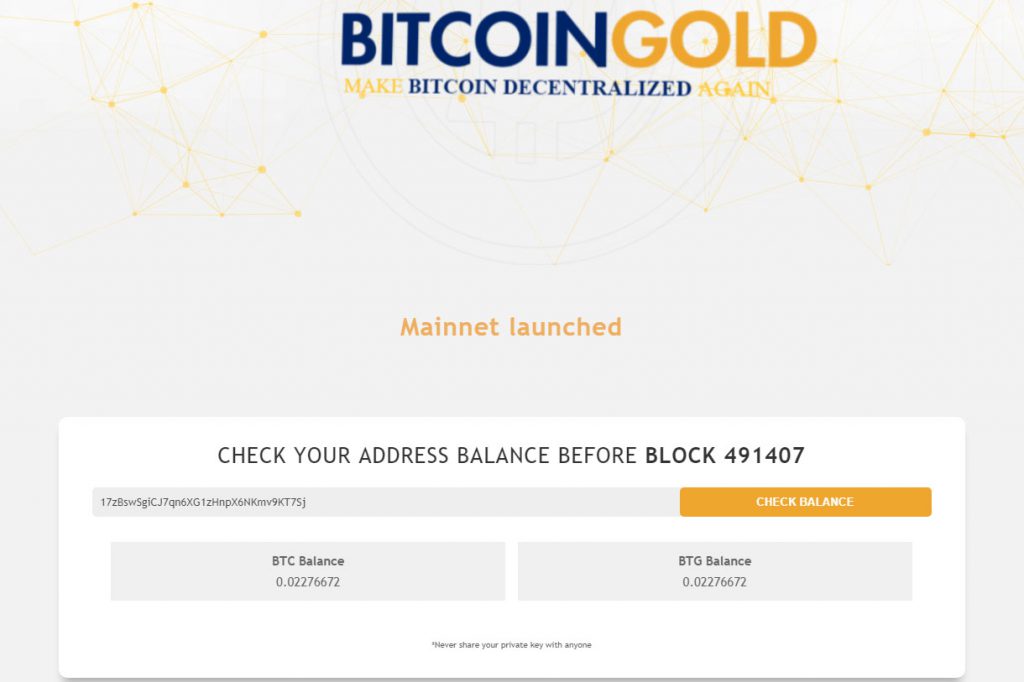

Go to the Bitcoin Gold Website and paste it into the claim box (‘Check Your Address Balance Before Block 491407’). With a bit of luck you’ll get a confirmation similar to this:

The BTC Balance column may be empty if you’ve moved out your BTC since, which is fine. In fact, this process of claiming BTG will expose the private keys of your Electrum Wallet so you are advised to move out your BTC to a new wallet anyway; this is just to avoid the small possibility of hacking.

(Note: We will be using a respectable intermediate wallet so the risk is fairly low – I won’t go through the process here for simplicity since the amount risked is also low. However for my personal BTC stash I won’t use the source Electrum Wallet again without wiping it first).

At this point you need to decide if you want to claim or not. In this case the claim is worth 0.0227 x $149 = £3.38 so it’s not really worth it (fees will be about £4), but I’ll go through it anyway to illustrate the method.

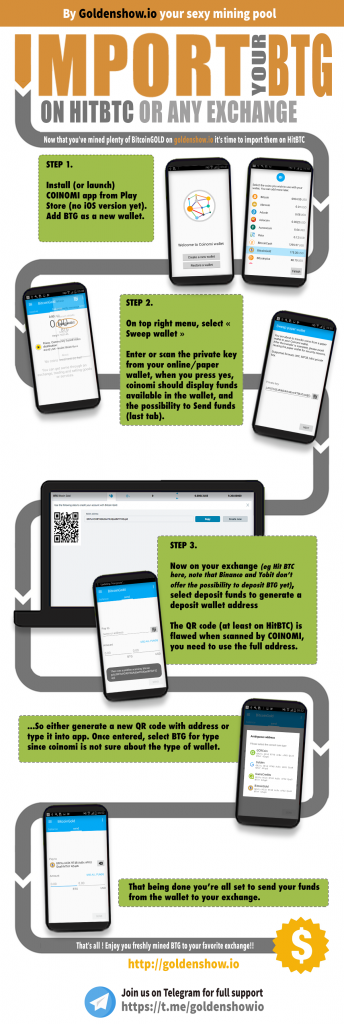

The process is relatively straightforward, if a bit fussy. You install the Coinomi app on an Android phone and give it your private keys so that it can access your new BTG. Coinomi is used as it’s one of the few respectable wallets that currently support BTG.

There is an infographic available that covers this part of the process quite well:

One thing that’s not made clear is how to get your Electrum private key in a form that Coinomi can recognise. To do that, in Electrum go to Wallet -> Private Keys -> Export, enter your password and wait a few seconds. Look for the line that matches the address of your BTC in the left column, and the key is in the right column – you need to type this into Coinomi as described in the infographic.

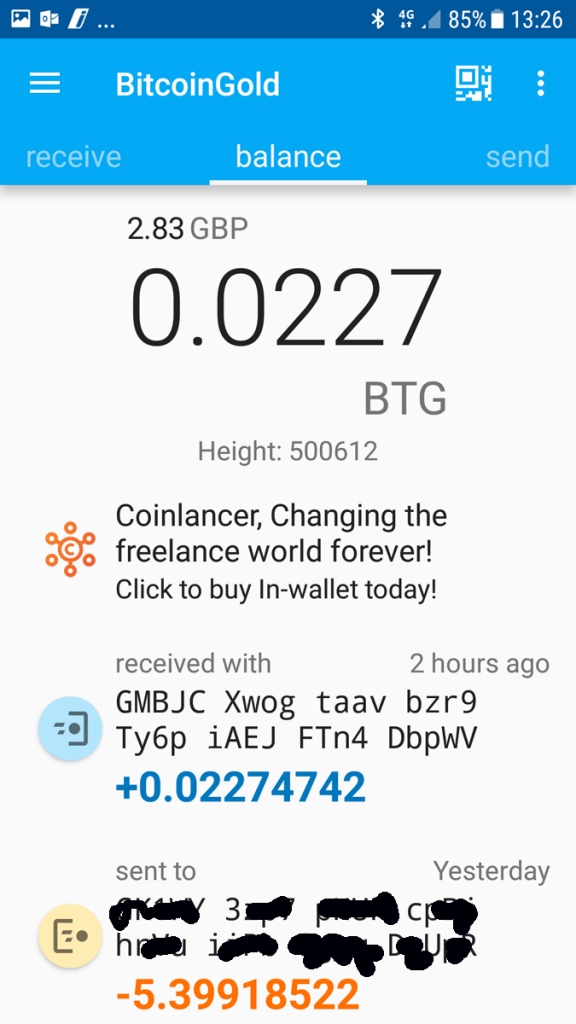

When it asks, hit Confirm and you should see your new Bitcoin Gold:

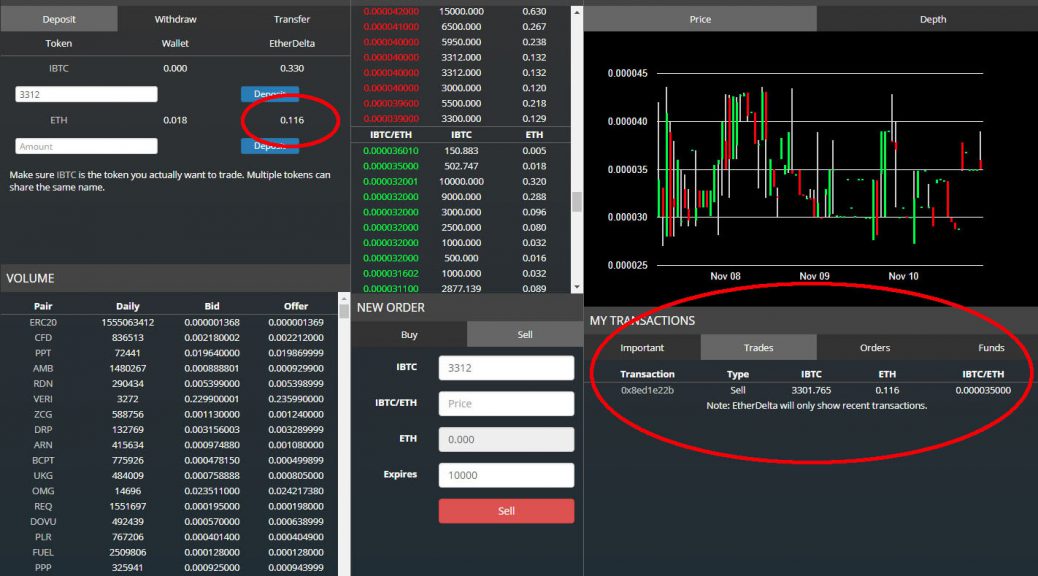

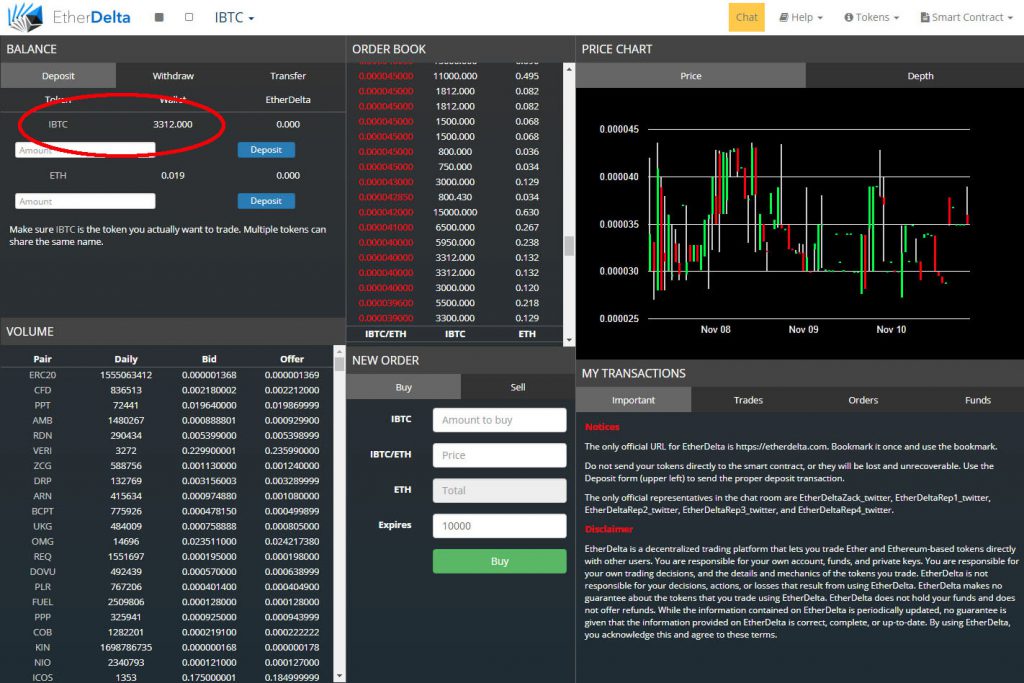

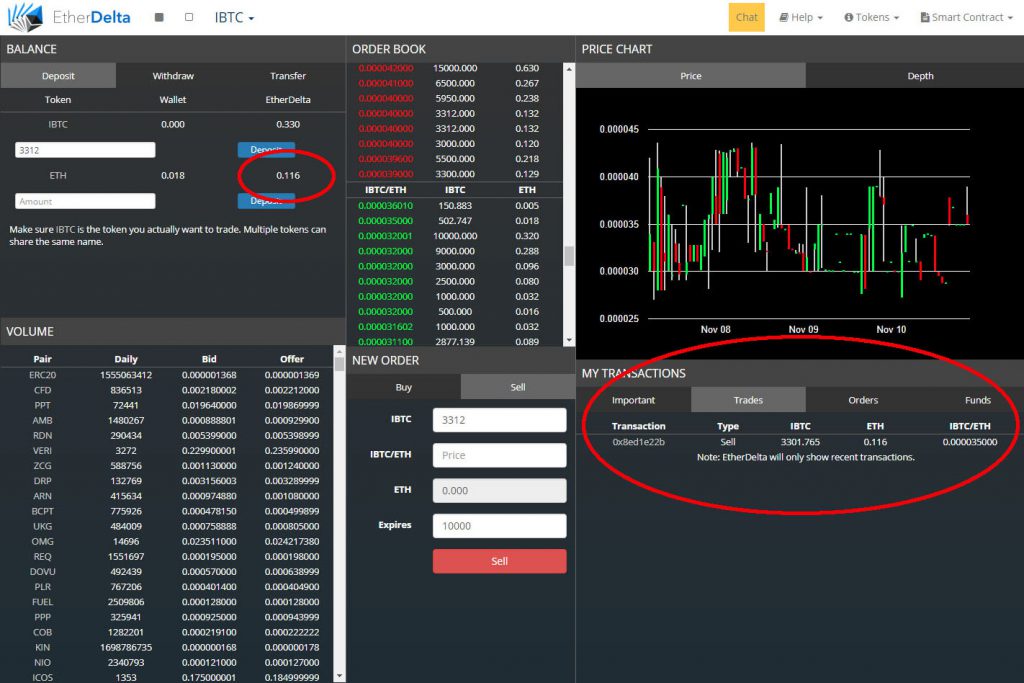

Open an account on the HitBTC exchange if you don’t already have one – again it’s one of the few exchanges that support BTG. It doesn’t have a great reputation so I wouldn’t recommend using it for large amounts of BTC.

Go to the Deposit page (via the menu in the top bar) and click Deposit in the BTG Bitcoin Gold row. In Coinomi select the Send tab and type in the Wallet address from HitBTC and press Use All Funds. If it asks you to confirm coin type select Bitcoin Gold, then Send, enter the password and Confirm.

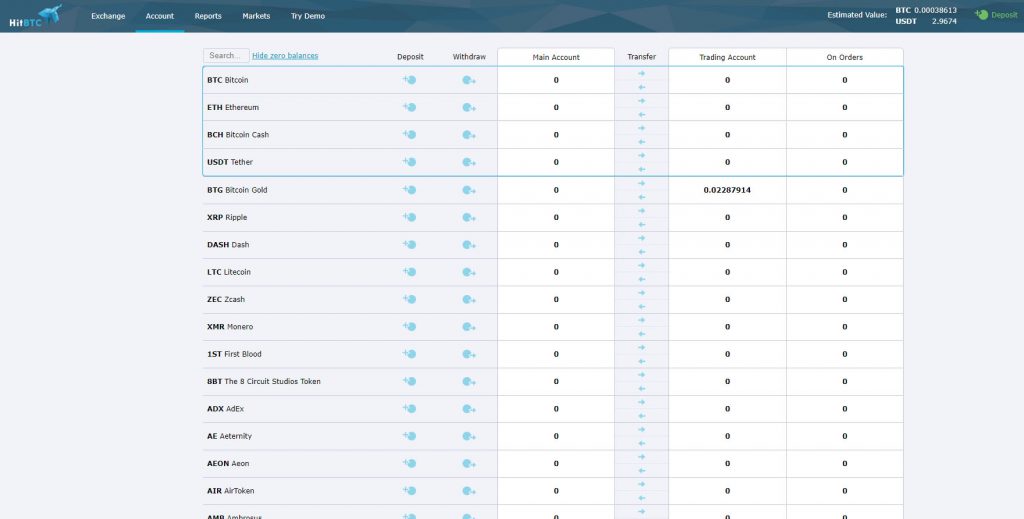

You’ll see the amount leave your Coinomi Wallet. Soon after you should see a wait cursor (rotating yellow circle) appear on the BTG line in HitBTC next to Main Account. Once the BTG appears, click on the arrow next to it to move it into Trading Account so you can sell it.

Click on Exchange in the top menu bar. To sell BTG look under Instruments for the BTC tab – click on Name to get the altcoins into alphabetical order and select BTG. To sell at a good price is, of course, an art in itself – you can use the chart on the left to judge whether it’s a good time to buy or not (has it just gone down or up, for example, what is the trend, etc.). However since i think BTG is generally going to trend downwards, as more people work out how to sell their free coins, let’s just sell immediately.

In the Sell BTG box click on your Balance to select all your BTG. Review the current Price (in BTC) and the resulting Total (in BTC). If you’re happy, press Sell Limit. You should get an acknowledgement and the BTG should be sold within a minute or two – you can confirm this in the My Trades tab under the chart. Note a small amount of BTG may not get sold and just be left behind in your BTG account (so-called ‘dust’).

If the market is falling your BTG may not get bought, for obvious reasons. If so you can find your BTG trade in the Active Order tab, cancel it, and try again at a lower price.

Your new BTC will now show in the top menu bar, and its equivalent value in dollars (USDT). To withdraw it click on the Account tab and in the BTC line press the arrow next to the BTC Trading Account value to move it into your Main Account. Press Withdraw and enter the amount to transfer.

At this point you enter the address where you want the BTC to go – if it’s back to your Electrum Wallet then you would find the address there by selecting the Receive tab to display it – copy and paste the address into HitBTC and press the Withdraw button.

As ever there will then be a delay as the transfer takes place and the BTC appears in your Electrum Wallet. (In fact, in the example I’ve shown here the amount of BTC gained from the trade isn’t enough to pay the fairly high minimum fee – £2 – to move the BTC out of HitBTC so I’m leaving it there until I can add more to it with further forks or airdrops).

And there you have it – your original BTC coins have increased by an amount equal to the value in BTG of the same amount of BTG coins, less trading fees.

Although it’s not worth going through this process with a small amount of Bitcoin, as demonstrated, it can be quite lucrative with a larger amount of Bitcoin. My personal account gained about £400 and some people will have made much, much more (“to whoever has, to him more shall be given…”) and all effectively for free.