I’ve covered how to sell Bitcoin cheaply on Coinbase. Next we need to know how to transfer the cash into our own bank account. The process is to select British Pound on the My assets page in the Coinbase interface, then select the Cash out all button:

then Continue:

At this point you can cash out to the debit card you originally used to buy Bitcoin, or select Add a debit card, but the fees on debit cards are high (£52.68 in this case) so we choose Add a bank account instead. Note that, as it says, we need to make a deposit into Coinbase from that bank account to link the two accounts together so we can then move our money in the opposite direction.

Now I believe there are two ways to do this. Firstly, you can select Add a bank account, then UK bank account:

There’s a scam warning (hit Continue) then we get the details we need to make a deposit to Coinbase:

However, that seemed to me a rather manual and awkward approach so I backed out. Instead, I used a different method, but it does require you to have a banking app on your phone. This way we will link the bank account to the Coinbase account before trying to withdraw the account balance.

Go to the Settings menu under your user profile (here the ‘L’ button top right), then select Payment methods, then Add a payment method. This gives the option of an Easy bank transfer, which wasn’t available through the first route:

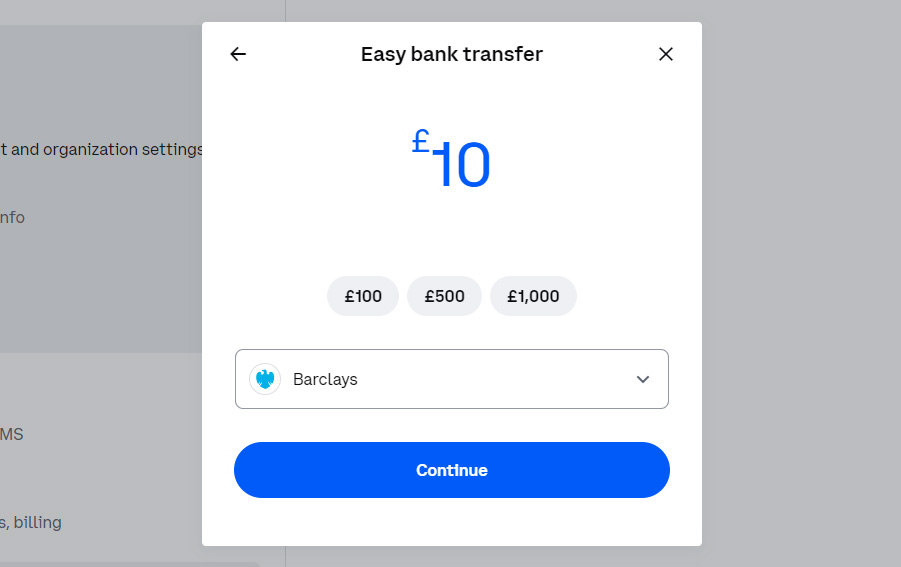

Select Easy bank transfer. There’s a scam warning (hit Continue), then enter a nominal amount to transfer from your bank account to Coinbase (e.g. £10) and select your bank by name:

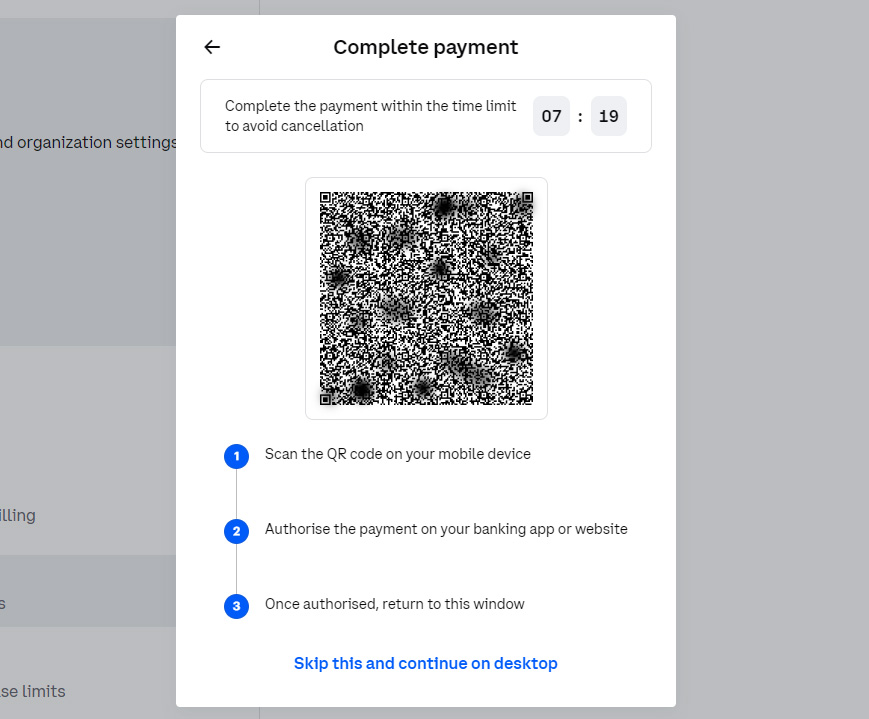

Select Continue. Then there’s some information given about the transfer, select Continue again. This creates a QR code page – follow the instructions: scan it, follow the link, authorise payment on your banking app, then return back to the page. Note you have around 7-8 minutes to complete the process before it times out:

At that point there is a deposit pending message:

In practice the deposit goes through quickly; it showed up on the My assets->British Pound page as soon as I clicked on the View account button:

The next time I clicked the Cash out all button and Continue there was a new option under Select a destination (for me it was the next day, so I don’t know how long it took to become available), and that was the bank account I had sent the £10 from as planned. Also, it was listed as Free:

Selecting that option, then Continue produces a Cash out preview:

Clicking on Cash out now causes a text code to be sent to your phone:

On entering the code we get a confirmation of the cash out request:

On selecting Done the money was instantly gone from the Coinbase account:

I immediately checked my bank account. There wasn’t a deposit showing, but the balance had increased indicating a pending deposit. When I checked the account the next morning, the money was in.

So that’s the process of withdrawing cash back out to your bank account. Although the first time is fiddly because of having to link your bank account, once that’s done it’s straightforward for all future cash outs.