I was asked at the start of the year what is bitcoin, is it all virtual, and are you actually buying and selling anything real? This is the answer I gave, and I’m reposting it here as it may be useful to newcomers.

In a nutshell Bitcoin is virtual or software money, it’s a little bit like how banks used to issue their own currency in the past. The clever thing about it is that it is trustless – for hundreds of years people have wanted a universal payment system that didn’t need a third party to take their money (credit and debit cards, PayPal, Western Union, etc.) and Bitcoin was the first to solve that. A network of computers around the world hold a record of all Bitcoin transactions ever, and when a new transaction (block) takes place it is added to the list of previous transactions with a software pointer to the previous transaction (so it is impossible to add, remove or replace any transaction without breaking the chain) – hence the term Blockchain. That makes Bitcoin virtually impossible to hack. Also anyone can run one of these computers – I did for a while – so it is completely decentralised and no-one can change Bitcoin or devalue it.

There will only ever be 21 million BTC, that is fixed, and 19M have already been issued, following an algorithm hardcoded into it. As to whether you are buying and selling anything real, that is a complex question. Since fiat currency (pounds, dollars, etc.) are no longer connected to anything but printed at will there you are definitely not buying and selling anything real – all you know is that there will be more next year and what you’ve got will be worth less, which can’t happen with Bitcoin. I don’t want to get into the politics, suffice to say a staggering amount of new currency was created in the pandemic (https://techstartups.com/…/80-us-dollars-existence…/) and we are starting to reap the effects of that with inflation and the cost of living crisis. Suffice to say that the big investment houses and banks know all this and have been getting into BTC for the last few years. A number of applications for Bitcoin funds have also gone in, with Blackrock the biggest, and approval is hoped/expected for January. At that point tens of thousands of businesses and pensions will be able to buy into Bitcoin ETFs, which will jump up the demand for Bitcoin (since any money invested has to be backed by the same amount of Bitcoin being bought, same as a gold ETF).

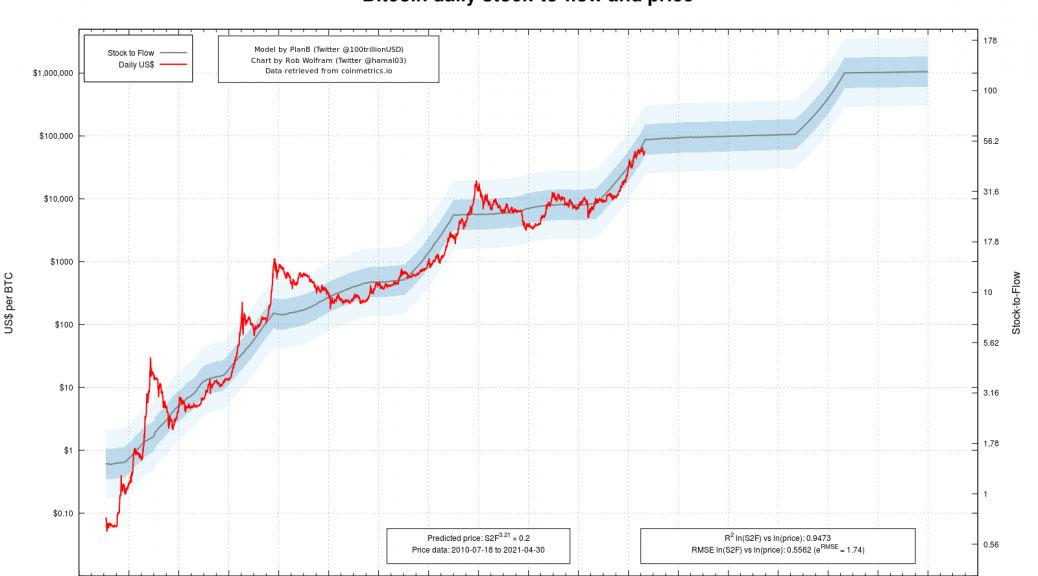

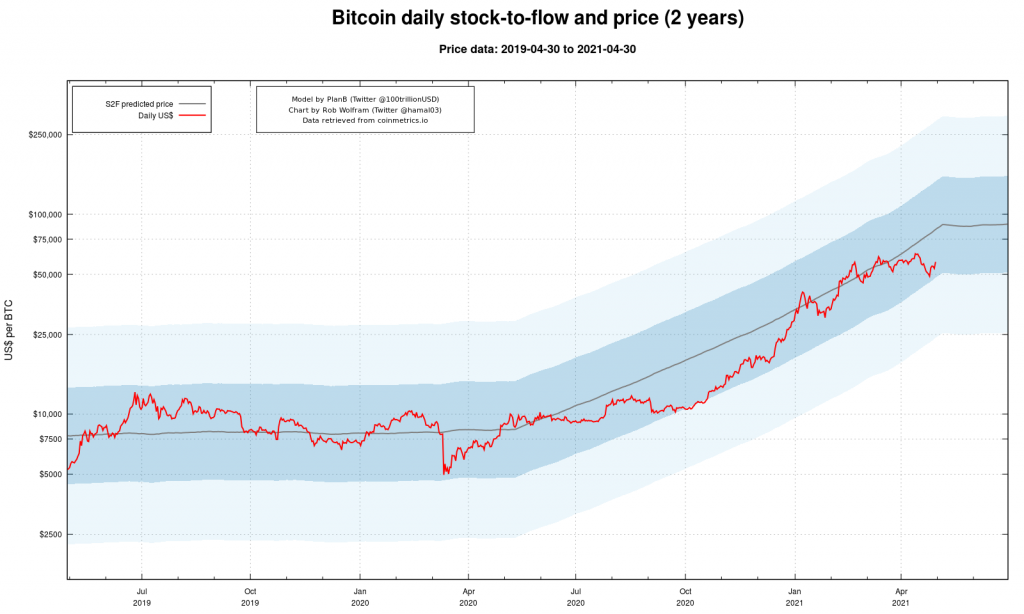

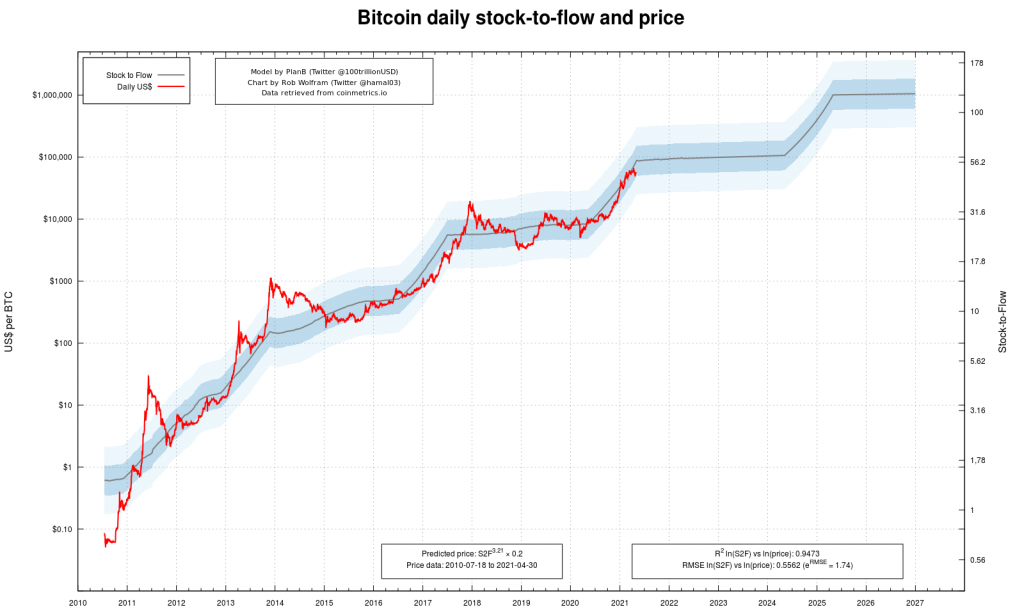

In parallel, the next halving is in April when the amount of Bitcoin produced per transaction halves, so we are hitting a demand/supply perfect storm. I believe Bitcoin will continue its bull run until late next year and will definitely exceed $80k but could potentially exceed $200k. My first 2 Bitcoin I bought for £500 each in 2017, and continue to buy in whenever I can. I think people with software knowledge are able to appreciate it better than most, and in the bigger picture we are still early into Bitcoin. Some people say it will eventually replace fiat currency altogether, as the world becomes more digitised, but certainly its increasing use by banks, and as sovereign currency (El Salvador so far, other countries likely to follow), show the direction of travel is clear. I expect in the next 4 year halving cycle (from early 2027) it could hit $1M per Bitcoin.